THE CLAIM SMART CONSUMER

It's an unfortunate reality that scam artists prey upon home and business owners in their time of need. Be a claim smart consumer.

Whether you're hiring a contractor to make repairs or a public insurance adjuster to help you understand and submit your insurance claim, make sure they are licensed to conduct business in Florida. You should even check the license and appointment of the insurance adjusters sent by your insurance company to make sure they are valid.

And don't forget, only public adjusters and lawyers are authorized by the law to negotiate a claim with your insurance company. Anyone else who offers to do so is committing a felony. The resources provided here can help you identify verified professionals who can help you navigate your claim and recover from tragedy.

Whether you're hiring a contractor to make repairs or a public insurance adjuster to help you understand and submit your insurance claim, make sure they are licensed to conduct business in Florida. You should even check the license and appointment of the insurance adjusters sent by your insurance company to make sure they are valid.

And don't forget, only public adjusters and lawyers are authorized by the law to negotiate a claim with your insurance company. Anyone else who offers to do so is committing a felony. The resources provided here can help you identify verified professionals who can help you navigate your claim and recover from tragedy.

THE ROLE OF PUBLIC ADJUSTERS

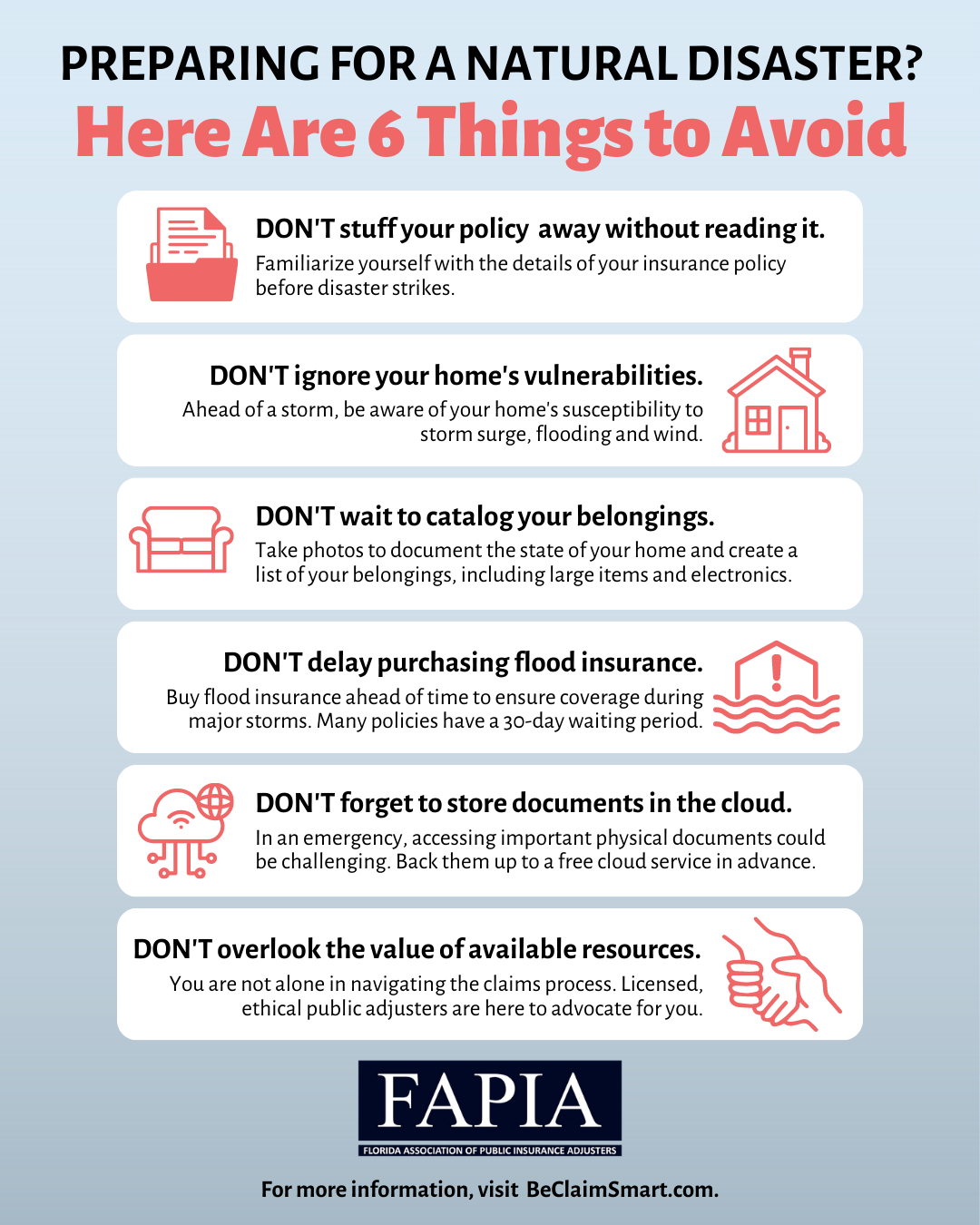

Public adjusters are licensed through the state of Florida to negotiate claims on behalf of consumers. As experts in the complex claims process, public adjusters may help policyholders receive a larger claim reimbursement, true to the terms of their policies. “Claim smart” consumers look for licensed public adjusters who can help them expertly navigate their policies during a time of loss.

VERIFY ADJUSTER LICENSE

Use the Florida Department of Financial Services license search to verify that an adjuster you are considering is licensed to work in the state. You may search by the name of the individual or the business and select “adjuster” for the license category.

One way to ensure you are working with a highly trained public adjuster is by choosing a public adjuster who is a member of FAPIA, the Florida Association of Public Insurance Adjusters. FAPIA members are licensed by the state, adhere to a strict code of ethics, and are able to take advantage of the best quality continuing education in the country.

VERIFY CONTRACTOR LICENSE

Use the Florida Department of Business & Professional Regulation search to confirm that the contractors you are considering to conduct repair work on your property are professionals who are licensed by the state.

STORM RESOURCES

Flood Insurance Tips

The National Flood Insurance Program (NFIP) is managed by FEMA and is delivered to the public by a network of more than 50 insurance companies and the NFIP Direct.

Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage. Most homeowners insurance does not cover flood damage. Flood insurance is a separate policy that can cover buildings, the contents in a building, or both.

There is often a dispute about whether the damage caused to any given property was caused by wind or flood since wind damage would be covered by the homeowner policy and flood through NFIP.

Your flood policy has several very strict requirements that a qualified and experienced licensed public insurance adjuster or attorney can help you navigate. Failure to meet any of the conditions set forth in the flood policy can cause your claim to be denied.

This is a federal program.

Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage. Most homeowners insurance does not cover flood damage. Flood insurance is a separate policy that can cover buildings, the contents in a building, or both.

There is often a dispute about whether the damage caused to any given property was caused by wind or flood since wind damage would be covered by the homeowner policy and flood through NFIP.

Your flood policy has several very strict requirements that a qualified and experienced licensed public insurance adjuster or attorney can help you navigate. Failure to meet any of the conditions set forth in the flood policy can cause your claim to be denied.

This is a federal program.

FEMA Assistance

Florida State Resources

Insurance In The News

Florida report on insurance failure raises more questions than answers, Tampa Bay Times by Lawrence Mower

How Florida let a top insurer abandon homeowners in their time of greatest need, Washington Post by Brianna Sacks

Expectant St. Pete mom in tears as Hurricane Ian insurance claim stays open, News Channel 8 by Mahsa Saeidi

Hurricane Ian results in nearly 8k property insurance complaints to the state, ABC Action News by Stassy Olmos

Home insurance adjusters who assessed Hurricane Ian damages claim companies deleted some findings, Fox 13 by Craig Patrick

How Florida let a top insurer abandon homeowners in their time of greatest need, Washington Post by Brianna Sacks

Expectant St. Pete mom in tears as Hurricane Ian insurance claim stays open, News Channel 8 by Mahsa Saeidi

Hurricane Ian results in nearly 8k property insurance complaints to the state, ABC Action News by Stassy Olmos

Home insurance adjusters who assessed Hurricane Ian damages claim companies deleted some findings, Fox 13 by Craig Patrick